Water Innovations and Investments are Growing Strong

The investor panel recording on the water innovations (Jan.26, 2024). Thanks to all the panelists for the great conversation and the chat record is here.

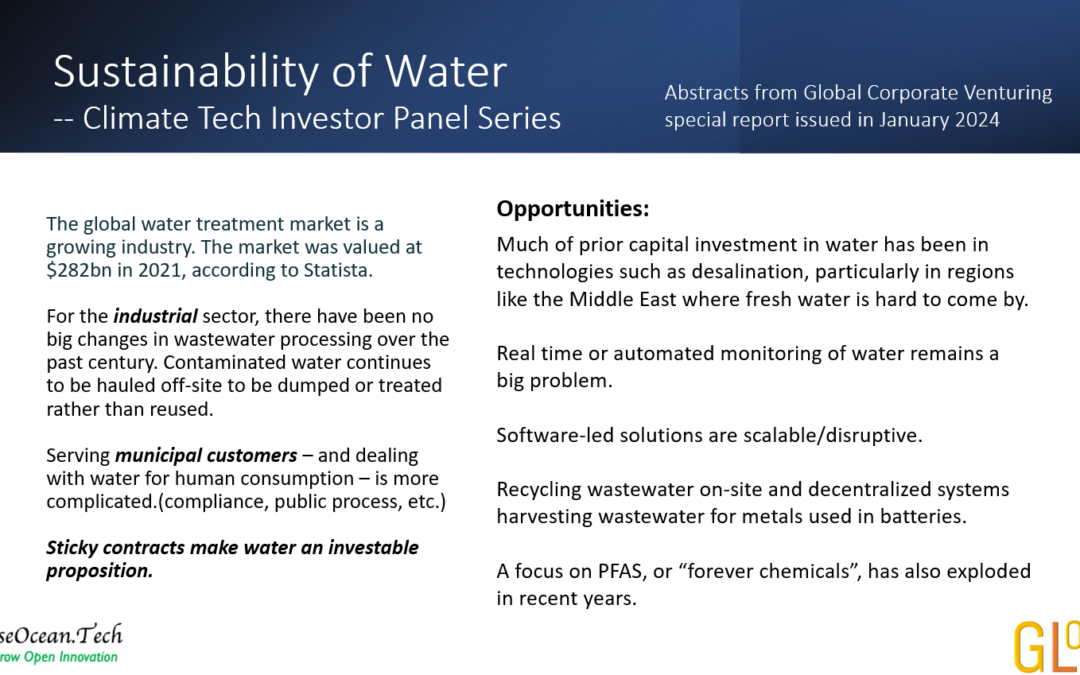

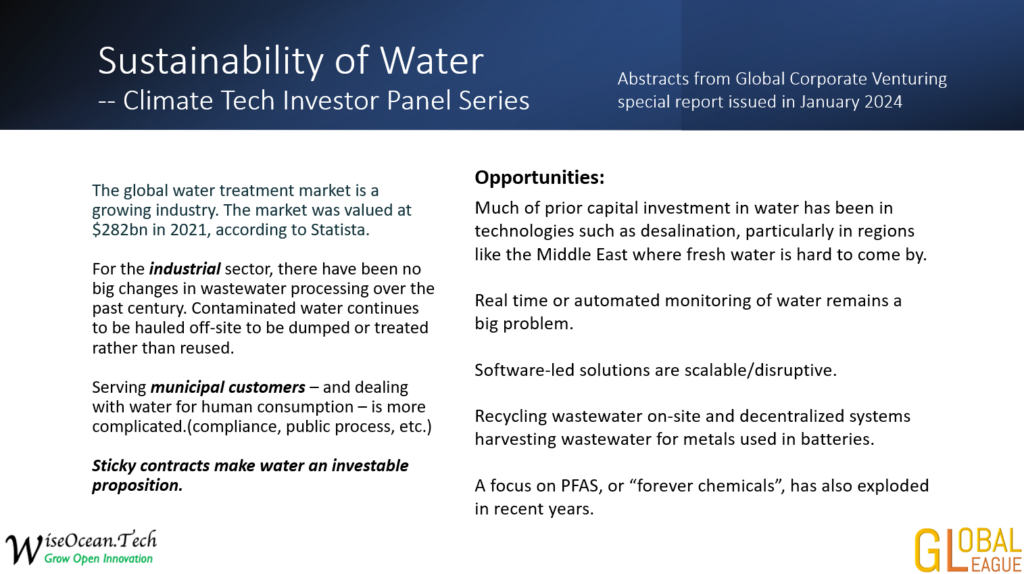

A suggestion from Paul Burgon, Exit Ventures – (he has a background in running the North American division of a public European water tech company and also being on their board)

My observations: I agree with your investment opportunities points. One clarification I would add: startups should not focus on customers in the municipal water sector, it is a complete mismatch. Municipal water operators are extremely risk averse and they won’t be interested in a startup’s new technology until it has seen years of use and testing, unless the municipality is almost desperate. They are very rarely desperate. So, startups should focus on industrial water testing and reclamation rather than municipal. The industrial segment will be much more open to trying newer technologies with a strong ROI and so startups can be much more successful in the industrial segment.

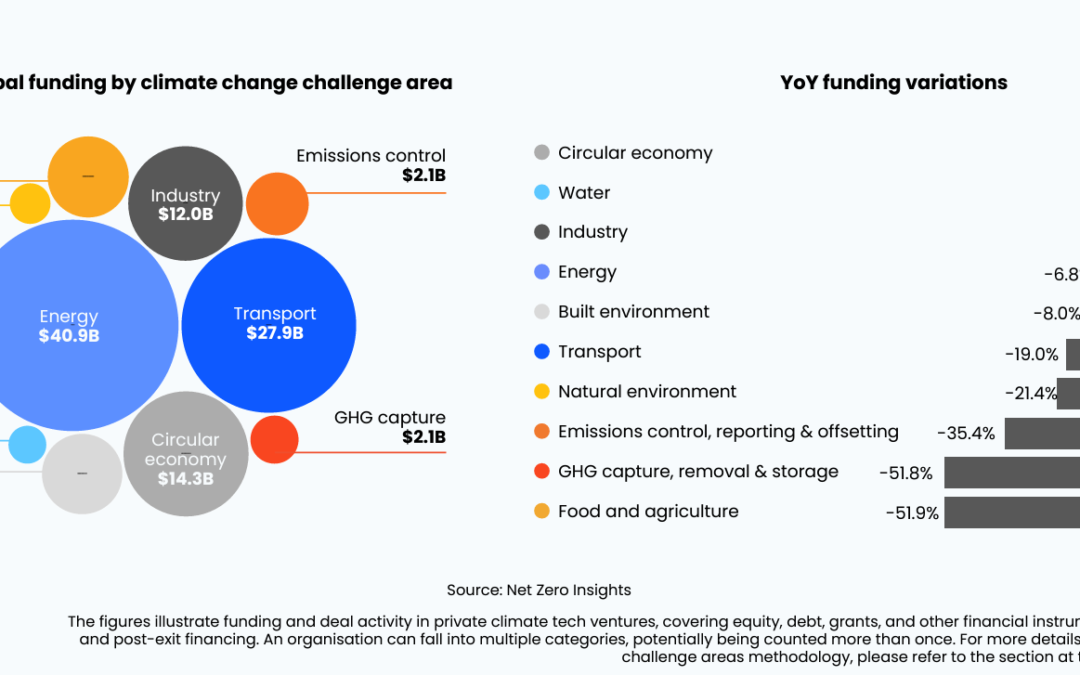

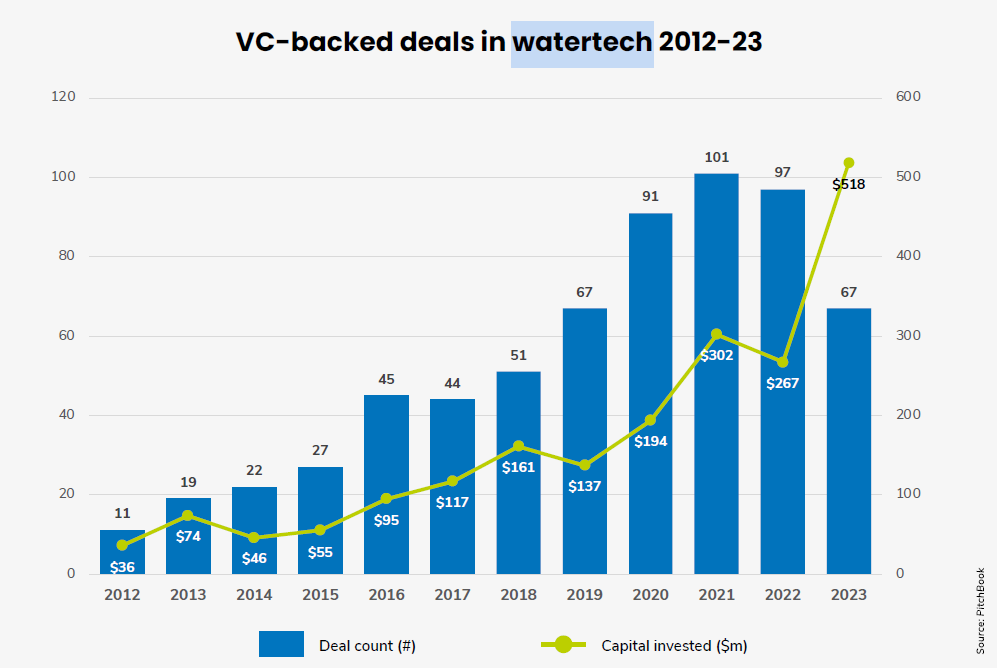

Context: In this downturn, VC investment amount in water tech is growing strong, since it’s underinvested in past years.

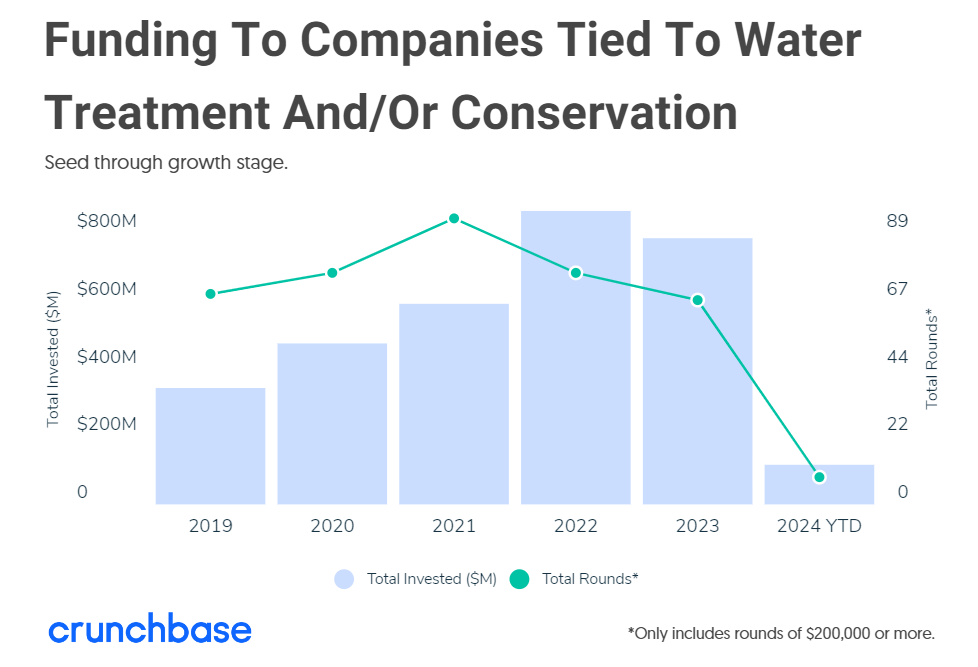

Highlights on water deals from Crunchbase: (published on Feb. 12, 2024)

Total funding to water industry categories in 2023 was higher than in 2021. And this year is also off to a strong start. The annual investment since 2019 to companies in the water, water purification, and water transportation categories is charted below.

10 Trends in Climate Tech in 2024 + AI and Climate

Climate Notes

Saudi Arabia ordered state-owned Aramco (ARMCO) to maintain its oil production capacity, marking a major reversal from the energy giant’s plan to boost capacity. The Maximum Sustainable Capacity of the world’s largest crude producer will be maintained at 12M bbl/day, instead of a planned capacity expansion to 13M bbl/day by 2027.

The European Union pumped out 8% less carbon dioxide from the fossil fuels it burned in 2023 than it did in 2022, the Guardian reported, pushing these emissions down to their lowest level in 60 years. Yet, over this period, the economy has tripled – showing that climate change can be combated without foregoing economic growth. More than half of the drop in emissions came from the use of cleaner electricity, the report found. The EU built record levels of solar panels and wind turbines in 2023, according to industry data, and was able to make more electricity from dams and nuclear power plants. Analysts say emissions overall are still falling too slowly.

S&P Global Commodity Insights has issued its latest report on the Top 10 Trends in Clean Energy Technology in 2024.

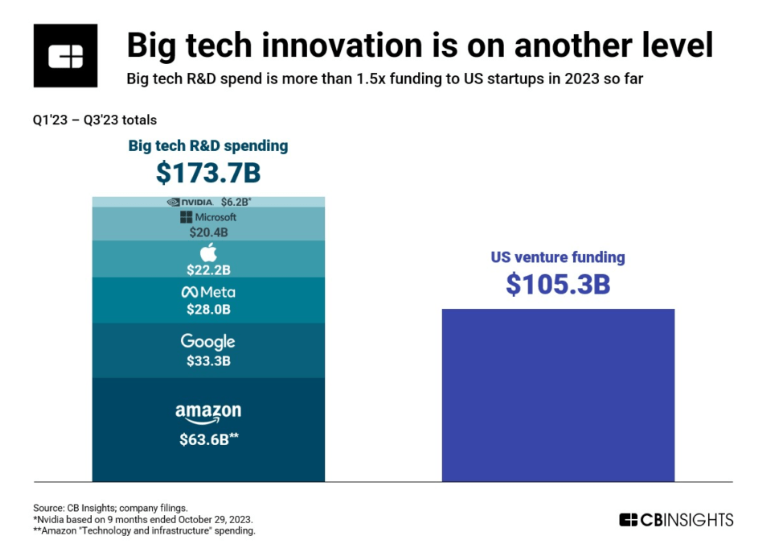

- Clean Energy Technology Investment to reach nearly US$ $800 billion in 2024 (up 10% to 20% from 2023) and $1 trillion by 2030. Solar will be the largest share of the additional spend and account for some 55% of the total investment. Onshore wind will be the second largest segment. The fastest-growing areas for new investments will be battery energy storage and electrolysis. CCUS and Hydrogen are both getting policy tailwinds.

- The average capex of clean energy technologies to decline by another 15%-20% by 2030. The combination of oversupply and falling raw material prices is rapidly driving down the costs of solar and batteries.

- Clean energy technology manufacturers are making decarbonization core to both products & and strategies. Two keys are 1) the use of low-carbon electricity, 2) a progressive reduction in materials consumption, and the use of lower carbon footprint materials.

- Oversupply is driving solar and storage manufacturers into a price war – compressing margins and jeopardizing localization efforts. Smaller manufacturers are likely to face negative gross margins.

- Expect record-high offshore wind capacity auctions in 2024 despite rising capital costs. More than 60 GW of new capacity is set to be auctioned in at least 17 different markets, enough to cover Poland’s total power demand.

- Western wind turbine giants face growing competition from the East. China’s recently announced turbine production surpasses that of Western counterparts by at least 30% in rated capacity, while the price gap has grown to nearly 70% between both groups. Expect the technology arms race and pricing pressure to continue.

- Expect higher global interest for low-carbon hydrogen as feedstock for ammonia, synthetic methane, and synthetic liquids. Aided by subsidies and driven by mandates, investment in hydrogen as a feedstock is now flowing.

- 2024 will be a milestone year for technology-based carbon dioxide removal (CDR). The EU is expected to adopt a carbon removal certification framework in 2024. A significant increase in projects can be expected in 2024, especially those aiming to capture biogenic and/or atmospheric CO2.

- Efforts to alleviate grid congestion and permitting constraints, a global phenomenon, will continue to streamline renewable power development. Global markets are expected to focus on two key means: 1) Higher investment in transmission and distribution (T&D) and storage. The biggest factor behind grid-connection bottlenecks is that T&D investment lags generation capacity investment. 2) Facilitation of development of other renewable technologies (e.g., offshore, geothermal), which have suffered from cost hikes and challenges in big interconnection and permitting.

- Transmission system operators (TSOs) will be required to assess flexibility needs from 2025, which will drive additional large-scale energy storage procurements.

We are meant to be in a golden era of investing in climate technology, but lots of investors have yet to reap the benefits. For example, the Invesco Solar ETF (TAN) is down more than 40% in the last year, with one of its largest holdings down 75% during the same period. SolarEdge’s revenue plummeted off a cliff in Q3 2023, and EnerSys (the market-leading battery provider) has also been losing businesses and firing workers in recent years and putting IRA central to its future growth. Hydrogen ETFs have lost 22% to 57% on a one-year timeline or lost 53% to 80% on a three-year timeline. Is it about timing, about company selection, or about missing something from the whole picture? Why? (Share your thoughts: Partner@WiseOcean.Tech)

AI and Climate

Sam Altman, OpenAI CEO, is engaged in discussions with key Middle Eastern investors and the Taiwanese chip giant TSMC to launch a new chip venture to design and build semiconductors for accelerating AI workloads as well as solving its power hunger. This initiative, aimed at reducing OpenAI’s dependence on Nvidia, involves collaboration with influential figures like Sheikh Tahnoon bin Zayed al-Nahyan of the UAE. Sheikh Tahnoon, a key figure in this negotiation, oversees substantial investment funds and entities in Abu Dhabi and is involved with G42, which collaborates with Microsoft and OpenAI. (One of the references)

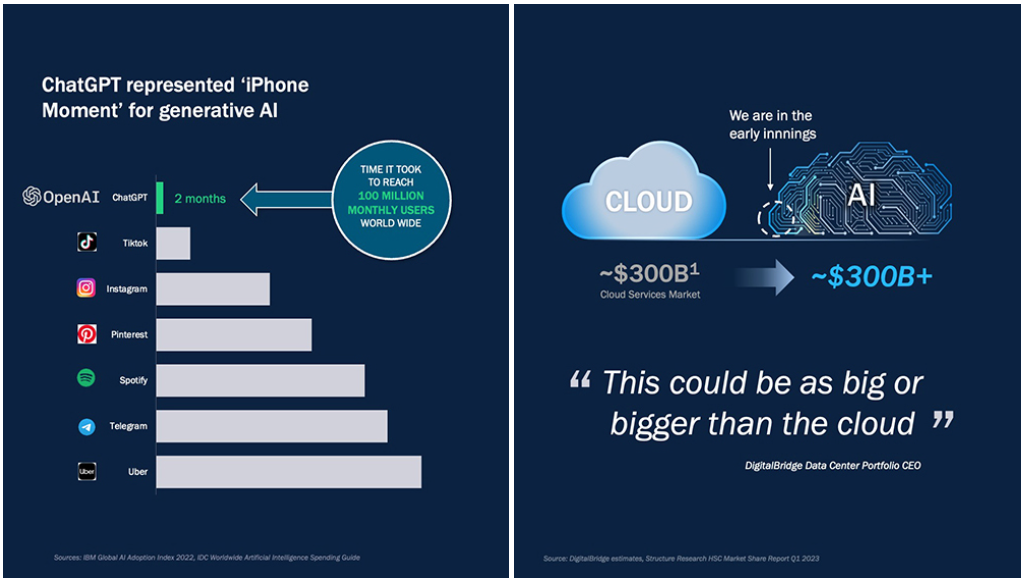

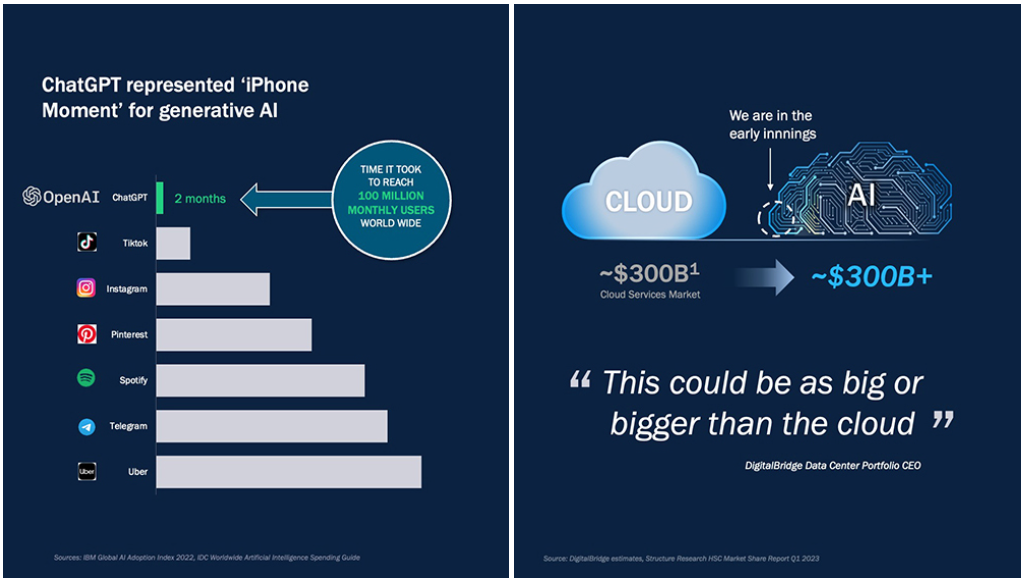

AI is currently supercharging the development of data centers. DigitalBridge pointed out: “With the speed of adoption of Generative AI being the fastest on record. We believe the Generative AI opportunity will be at least as big as the cloud market today over the next 5-10 years… Access to digital infra in size, at the lowest total cost, is a key success factor. The new specialized AI chips and GPUs consume 2-3x the power of prior generations. There is going to be higher power density on a per rack basis with each rack filled with power-hungry GPUs drawing 40 or more Kw compared to traditional data center racks drawing 10kw or less.”

The number one operating cost of data centers is power! Generative AI makes the data center demand from megawatt to gigawatt scale. That adds extra stress to grids or is even prohibitive without some change. And, regulations will require disclosure of carbon emissions, sustainability is more than a buzzword. There is evidence that LPs are aware of the scale of data center opportunities, and its power hunger issue (also water). Using a combination of grid-sourced power and a portfolio of other renewables, small modular nuclear reactors, and even LNG and batteries are all possibilities. (more)

Quoted from Robeco: “To illustrate, Nvidia’s currently supplied A100 AI chip has a constant power consumption of roughly 400W per chip, whereas the power intake of its latest microchip, the H100, nearly doubles that – consuming 700W, similar to a microwave. If a full hyperscaler data center with an average of one million servers replaced its current CPU servers with these types of GPUs, the power needed would increase 4-5 times (1500MW) – equivalent to a nuclear power station! Current data centers are ill-equipped and in need of a revamp, upgrades will benefit the smart energy themes.” (more)

We might review AI chip innovations with sustainability impact later.

Investor Partnership

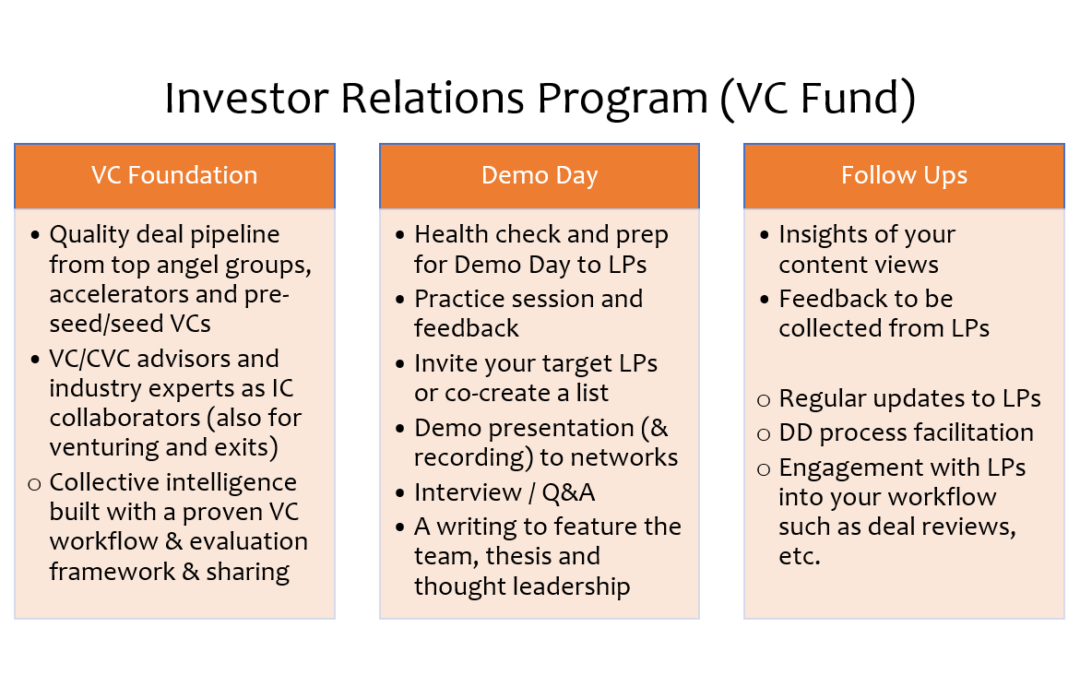

Our partnership with fund managers or family offices is based on our Global League knowledge community and expanding investor networks as well as outreach efforts to support investors. First of all, the core of our investor partnership is the collective intelligence...